THE RETURN OF BORROWING IN SUPERANNUATION?

Australia has more than 550,000 Self Managed Superannuation Funds ("SMSF") in operation. Since it was allowed in 2007, gearing via Superannuation has been popular to accelerate asset acquisition inside this structure.

IS THE SMSF STRUCTURE RIGHT FOR ME?

Firstly, a SMSF is fundamentally at least, a good thing as it allows complete control over your superannuation.

There is the flexibility to invest in things that you generally can't do within a retail super fund, and there is also the capacity to have family included - up to four members can be part of your structure.

On the flip side, there are a number of direct costs, including audit and annual reporting fees.

As a sweeping generalisation, a red flag is where people without existing SMSF's structures in place, look to create one for the sole purpose of acquiring property.

There is a lot written about the worth of SMSF's, the key thing here is to seek advice.

HOW DOES BORROWING IN SMSF WORK?

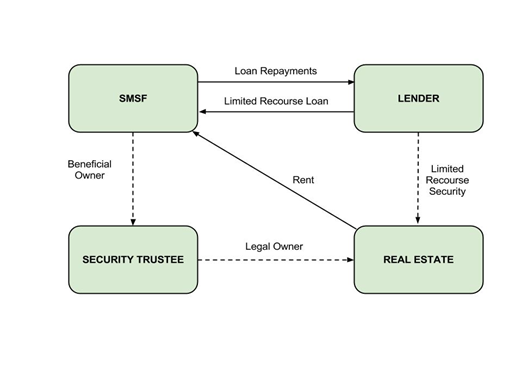

A SMSF can borrow to assist in acquiring Real Property. The arrangement is commonly referred to as Limited Recourse Lending.

The property being purchased is isolated in a Bare Trust or Property Trust which will have a different trustee to the SMSF. This ensures that the assets of the SMSF are protected and there is “No Recourse” at all by the Bank to the assets of the SMSF.

BANK SUPPORT

Traditionally, this product was accessed by existing SMSF holders running established businesses or investment strategies, though it also became a vehicle for individuals seeking the quick fix dream of financial prosperity - usually involving residential property.

As an indirect result, and with the ongoing scrutiny applied to banks - it is a fairly easy lever to turn off.

More recently, most lenders have put some good common sense policies in place to make it harder for new entrants. For example, a specific requirement that the SMSF is to hold some initial liquidity and also hold other assets outside a property being purchased.

Some financiers have supported lending arrangements on the following basis:

- Provide a 1st Registered Mortgage on the Security Property.

- A Guarantee and Indemnity from the Custodial Trustee.

- All Members of SMSF Trustee structures provide unsupported Personal Guarantees, limited to the loan principal, fees and charges.

During 2022, we have seen a stronger appetite to supprt SMSF lending, with a number of financiers either entering the market or driving more competition in terms of pricing and rates.

OPPORTUNITY COST

It is important too to consider the extra cost of borrowing using SMSF. Typically, this would involve an interest rate premium of around 2.5% against borrowing "outside".

Using the example of say a $1M loan over a 15 year term, this is an interest cost premium of over $220k. So the benefits (tax etc.) need to offset this cost over the term of the loan.

THE FUTURE

The Association of Superannuation Funds of Australia has not historically been supportive of superannuation borrowing. There is no doubt that the availability of SMSF lending has been a further influence for less experienced investors to speculate into property. So will need to watch this space.

The concept of using gearing via SMSF is still in our view an excellent one, in the right circumstances. Especially for business owners looking to own property as a separation from their operating business activities.

FINAL THOUGHTS

In our view, decisions should never be made from the perspective of a taxation advantage or incentive. So before leaping into an investment in SMSF, check in to why you are doing it in the first place. Is it a good decision? If yes, the right structure for it can follow and your SMSF could be a part of that.

With a highly competitve debt market, it is clear that borrowing in this category is here to stay in the medium term. New competitors saw some fat in the existing margins and now they are after a piece of it.