GROWTH FOR BANKING BUSINESSES

How do I keep my book growing? There are many good resources to read on growth, perhaps better than any specific insights listed here. Though in the context of growth, engrained in my head is the words of a successful business mentor that always reminds businesses to “Focus on the Revenue”.

His message was that when businesses grow, they tend to invest a lot of time in activity that is not highly valuable. They then fall into a cycle where Revenue falls, and a cycle of cost reduction follows.

But Why Grow? There are several, and perhaps obvious, potential benefits of growing which can also include merger or acquisition activity too. Some potential benefits include:

• Some diversity can reduce business risk.

• Opportunity for your people to develop, provide careers and retain them.

• A recovery of your fixed overhead or excess capacity.

• Broaden your own experience and skills.

• Utilise the capacity in your business.

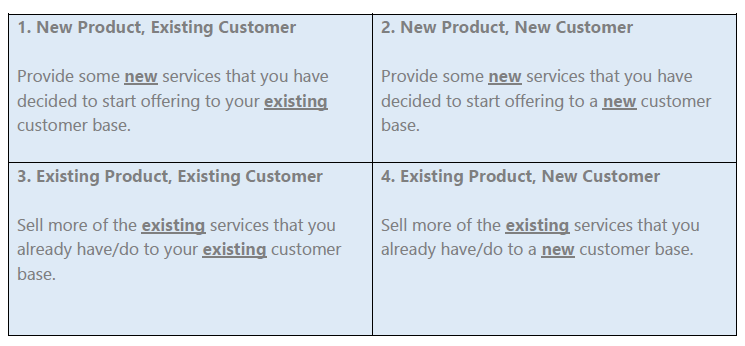

The options for growth can be divided into four categories:

These options may seem very obvious; however, it is a good template when looking at your options should you choose to grow. New Customers, for example, can provide a great opportunity to establish a fresh positioning around your services and what problems you solve for customers.

A common challenge for a banking business that are well established, is to manage the inevitable level of run off that occurs as a result of discharging loans or making debt reductions to existing facilities.

This is where you could consider investing in more support to help manage existing customers and reduce the level of loan run off that occurs in your practice.

This investment may include sales, marketing or customer management support.

It need not be an exhaustive investment and one that will usually drive a substantial financial benefit in the longer term.

Can I pivot into other Services?

A common theme is to extend their service offerings to other services. In the matrix above, this is an example of New Products to New or Existing Customers.

Whilst this makes sense to support new and existing customers – it is important to build the proper support mechanisms to ensure that these services are delivered appropriately.

A common example is a finance broker seeking to pivot to commercial finance introductions. The business case is an obviously one and there has been material growth in the number of brokers offering commercial finance services.

Most commonly however, the owner does not have the will or the skill to delivery these services on a professional basis.

If you are to do this, invest some time into designing what the service will look like, who you will provide it to and determine the skills your business needs to acquire before doing this properly.

Lastly, seek out the support, tools and resources that you need to deliver on a sustainable basis.